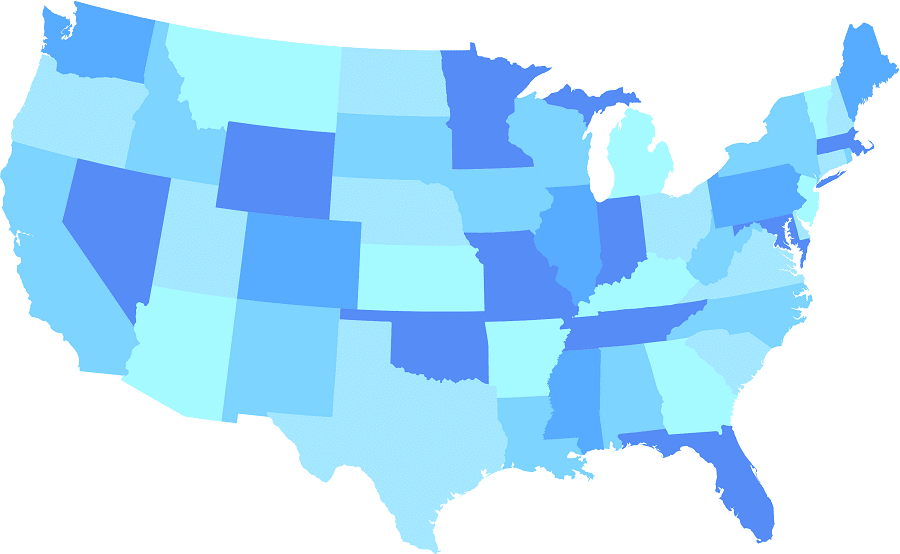

Exempt Employee Salary Threshold Rises Across The United States in 2018

State Salary Thresholds increase in 2018 for Exempt Employees

Last year employers anxiously watched as the Department of Labor (DOL) announced a rule requiring the salary threshold for exempt employees to double. The new overtime rule required that employees see a new salary of $47,476 in order to qualify as an exempt employee and be exempt from overtime pay.

This salary threshold was in addition to the duties test, which required employees to qualify as either executive, administrative, or professional.

21 states then filed suit challenging the validity of the new rule, which was to take effect on December 1, 2016.

A federal judge halted the implementation of the rule in December 2016 and after President Trump took office, the DOL took a few months to decide on its course of action.

Then, at the end of July 2017, the DOL started taking public comment as it looks to revise a new Overtime Rule. Currently, the final outcome of the old or a new overtime rule is still uncertain.

However, even as employers anxiously wait on the DOL decision, many states have local salary thresholds rising in 2018.

Currently, the salary threshold for exempt employees rests at $455 a week or $23,660 annually. These employees are exempt from being paid overtime for hours worked over 40 each week.

Every state law is different and some exempt employees from the state minimum wage while other states only exempt the employee from overtime hours.

For an updated list of all the minimum wage changes in 2018 check out our article here.

Alaska Exempt Employee Salary Threshold

Alaska requires that exempt employees be paid a minimum of two times the state minimum wage for the first 40 hours worked in a week.

Wages cannot include any employer provided boarding or lodging. Alaska’s minimum wage in 2018 will be $9.85.

Alaska’s minimum wage and Salary threshold updates on January 1, 2018.

| Wage by the period | 2017 | 2018 |

| Weekly | $784 | $787.20 |

| Bi-weekly | $1,568 | $1,574.40 |

| Semi-Monthly | $1,698.67 | $1,705.50 |

| Monthly | $3,397.34 | $3,411.20 |

| Annually | $40,768 | $40,934.40 |

Arizona Exempt Employee Salary Threshold

Arizona exemption for professional, administrative and executive employees does not exempt the employee from receiving the state’s minimum wage.

It only exempts overtime pay. Arizona minimum wage increases to $10.50 on January 1, 2018.

California Exempt Employee Salary Threshold

California requires that exempt employees make at least twice the wages of a minimum wage employee for full-time employment. The minimum wage changes on January 1, 2018.

California minimum wage breaks down into two wages, which are dependent on whether the employer has more or less than 25 employees.

California State minimum wage will be $11.00 for large employers with 26 or more employees. Small employers see the minimum wage increase to $10.50.

It is also important to note that many cities and counties throughout California have local minimum rates that are higher than the state wage.

However, these minimum wages do not affect the salary threshold for exempt California employees. State minimum wage and the new salary thresholds take effect January 1, 2018.

| Salary Period | 2017 Large Employer | 2018 Large Employer | 2017 Small Employer | 2017 Large Employer |

| Weekly | $840 | $880 | $800 | $840 |

| Bi-Weekly | $1680 | $1,760 | $1,600 | $1,640 |

| Semi-Monthly | $1820 | $1,906.67 | $1,733.34 | $1,820 |

| Monthly | $3,640 | $3,813.34 | $3,466.67 | $3.640 |

| Annually | $43,680 | $45,760 | $41,600 | $43,680 |

The exemption for California commissioned employees requires that the employee’s regular rate of pay be 1 ½ times California’s minimum wage, based on the employer size.

Colorado Exempt Employee Salary Threshold

Colorado salary threshold changes on January 1, 2018. It requires that exempt employees who qualify for overtime exemption as an executive or supervisor position must earn in excess of the minimum wage for all hours worked during a workweek.

Administrative and professional employees must simply be paid a salary.

One exception is that doctors, lawyers, teachers, and other highly skilled employees in technical computer occupations do not have to be paid a salary to be exempt from the Colorado salary threshold.

Administrative and Professionals exemption requires only that the employees be a “salaried employee.”

Executive or supervisor employees who work hours other than a regular 40 hour week must be paid at least minimum wage for those hours worked. Colorado minimum wage is $10.20 an hour on January 1, 2018.

For example an executive who works 40 hours must be paid more than $408 per week. (40 x $10.20). An executive who works 50 hours must be paid more than $510 per week.

| Salary Period | 2017 for 40 hours worked | 2018 for 40 hours worked |

| Weekly | Exceed $372 | Exceed $408 |

| Bi-Weekly | Exceed $744 | Exceed $816 |

| Semi-Monthly | Exceed $806 | Exceed $884 |

| Monthly | Exceed $1,612 | Exceed $1,768 |

| Annually | Exceed $19,344 | Exceed $21,216 |

Colorado’s exemption for commissioned employees requires that the employees regular rate of pay be 1 1.2 times the state’s minimum wage.

Connecticut Exempt Employee Salary Threshold

The minimum wage in Connecticut is not scheduled to changed. However, a “short test” must be used to qualify an employee for exempt status under state law.

The employee must be compensated on a salary or fee basis that excludes boarding, lodging and other facilities.

The required rate of pay must be at least $475 per week.

District of Columbia

Washington D.C. requires that commissioned employees regular rate of pay be 1 ½ times the districts minimum wage.

That minimum wage increases to $13.25 per hour on July 1, 2018.

Iowa Exempt Employee Salary Threshold

Iowa also does not change minimum wage, but requires a “short test” that exempt employees be paid a higher weekly wage than the minimum requirement of $455 per week.

Iowa requires that exempt employees be paid at least $500 per week.

Compensation cannot include lodging, board or other facilities.

Maine Exempt Employee Salary Threshold

Maine’s salary threshold for exempt employees changes on January 1, 2018. It becomes $10.00 an hour.

Maine’s salary threshold must be higher than 3,000 times the states minimum wage for an annual salary.

In other words, since the minimum wage is $10.00 an hour, the annual income for an exempt employee must exceed $30,000 (3,000 x 10).

If the FLSA salary exemption exceeds Maine’s salary threshold, then the FLSA salary threshold would apply.

| Salary Period | 2017 | 2018 |

| Weekly | Exceed $519.23 | Exceed $576.92 |

| Bi-Weekly | Exceed $1,038.46 | Exceed $1,153.84 |

| Semi-Weekly | Exceed $1,125 | Exceed $1,250 |

| Monthly | Exceed $2,250 | Exceed $2,500 |

| Annually | Exceed $27,000 | Exceed $30,000 |

Minnesota

Commissioned employees in Minnesota are only exempt from overtime pay if their regular rate of pay exceeds 1 ½ times the state’s minimum wage.

The new minimum wage in Minnesota will become $9.65 on January 1, 2018 for large employers and $7.87 for small employers.

Large employers are businesses who have at least $500,000 in annual gross sales and small employers are those businesses who have less than $500,000 in annual gross sales.

Nevada

Nevada commissioned employees can only be exempt from minimum wage if their regular rate of pay exceeds 1 ½ times the state’s minimum wage.

The current minimum wage is likely to change on July 1, 2018 and will be based on whether or not the employee receives health benefits.

New Jersey Exempt Employee Salary Threshold

New Jersey exemption for professional, administrative and executive employees does not exempt the employee from receiving the state’s minimum wage.

It only exempts overtime pay.

New Jersey’s minimum wage increases to $8.60 on January 1, 2018.

New York Exempt Employee Salary Threshold

New York State has the most complex minimum wage laws in the United States.

Additionally, their minimum wage changes on December 31st of each year. The laws vary according to location, business size, and even industry.

As a result, the salary threshold for exempt employees also varies across the state and according to business industry and size. Executive and administrative employees must be paid a salary for services, including board, lodging, and other allowances.

Professional employees do not have a salary threshold and thus would need to be paid at least the federal requirement with a salary of $23,660.

| New York City

11+ Employees |

2017 | December 31, 2017 | December 31, 2018 |

| Weekly | $825 | $975 | $1,125 |

| Bi-Weekly | $1,650 | $1,950 | $2,250 |

| Semi-Monthly | $1,785.50 | $2,112.50 | $2,437.50 |

| Monthly | $3,575 | $4,225 | $4,875 |

| Annually | $42,900 | $50,700 | $58,500 |

| New York City

1-10 Employees |

2017 | December 31, 2017 | December 31, 2018 |

| Weekly | $787.50 | $900 | $1,012.50 |

| Bi-Weekly | $1,575 | $1,800 | $2,025 |

| Semi-Monthly | $1,706.25 | $1,950 | $2,193.75 |

| Monthly | $3,412.50 | $3,900 | $4,387.50 |

| Annually | $40,920 | $46,800 | $52,650 |

| Nassau, Suffolk & Westchester Counties | 2017 | December 31, 2017 | December 31, 2018 |

| Weekly | $750 | $825 | $900 |

| Bi-Weekly | $1,500 | $1,650 | $1,800 |

| Semi-Monthly | $1,625 | $1787.50 | $1,950 |

| Monthly | $3,250 | $3,575 | $3,900 |

| Annually | $39,000 | $42,900 | $46,800 |

| Rest of New York State | 2017 | December 31, 2017 | December 31, 2018 |

| Weekly | $727.50 | $780 | $832 |

| Bi-Weekly | $1,455 | $1,560 | $1,644 |

| Semi-Monthly | $1,576.25 | $1,690 | $1,802.67 |

| Monthly | $3,152.50 | $3,380 | $3,605.34 |

| Annually | $37,830 | $40,560 | $43,264 |

New York general wage order requires that employers must pay employees for overtime at a wage rate of 1 ½ times the employee’s regular rate in the manner and methods provided in the FLSA section 7 rules.

However, it is unclear if payment is based on the Federal minimum wage or the applicable New York minimum wage.

Oregon Exempt Employee Threshold

Oregon minimum wage increases on July 1, 2018. As a result, the salary threshold for exempt employees also increases.

Oregon minimum wage applies to a Standard Rate for the state, except specific counties which have a higher minimum wage and are considered either Urban or Non-Urban. Oregon standard minimum wage will rise to $10.75 on July 1, 2018.

Non-Urban minimum wage will rise to $10.50.

Urban minimum wage changes to $12.00.

Even within certain counties, specific areas may have an urban or a non-urban minimum wage. The exempt salary wage excludes lodging, board, and other facilities.

Oregon’s exempt salary threshold is calculated by taking the applicable minimum wage and multiplying it by 2080 hours per year. That total is then divided by 12 months.

| Standard Min. Wage | 2017 (as of July 1, 2017) | July 1, 2018 |

| Weekly | $410 | $430 |

| Bi-Weekly | $820 | $860 |

| Semi-Monthly | $888.34 | $931.67 |

| Monthly | $1,776.67 | $1,863.33 |

| Annually | $21,320 | $22,360 |

| Urban Min. Wage | 2017 (as of July 1, 2017) | July 1, 2018 |

| Weekly | $450 | $480 |

| Bi-Weekly | $900 | $960 |

| Semi-Monthly | $975 | $1,040 |

| Monthly | $1,950 | $2,080 |

| Annually | $23,400 | $24,960 |

| Non-Urban Min. Wage | 2017 (as of July 1, 2017) | July 1, 2018 |

| Weekly | $400 | $420 |

| Bi-Weekly | $800 | $840 |

| Semi-Monthly | $866.67 | $910 |

| Monthly | $1,733.34 | $1,820 |

| Annually | $20,800 | $21,840 |

Commissioned employees in Oregon must receive a regular rate of pay of at least 1 ½ the applicable state minimum wage.

Rhode Island Exempt Employee Salary Threshold

Rhode Island’s exemption for professional, administrative and executive employees does not exempt the employee from receiving the state’s minimum wage.

It only exempts overtime pay Rhode Island’s minimum wage increases to $10.10 on January 1, 2018.

South Dakota Exempt Employee Salary Threshold

South Dakota’s exemption for professional, administrative and executive employees does not exempt the employee from receiving the state’s minimum wage.

It only exempts overtime pay South Dakota’s minimum wage increases to $8.85 on January 1, 2018.

Washington

In order for a commission employee to be exempt from overtime payment, state law requires the employee to earn a regular rate of pay of at least 1 ½ the state’s minimum wage.

The state’s minimum wage will be $11.50 per hour on January 1, 2018.

Commission Employees Overtime Exemption Minimum Pay Increases

Under the Fair Labor Standards Act 7(i) overtime exemption provides specific rules by which a commissioned employee can be exempt from overtime pay.

Federal law requires that most employees be paid 1 ½ times their regular rate of pay for any overtime worked in a pay period. In order for a commissioned employee to be exempt from overtime pay three conditions must all apply.

- The employee must work for a retail or service establishment

- The employee’s regular rate of pay must exceed 1.5% of the Federal minimum wage for every hour worked in a week with overtime hours worked

- More than 50% of the employee’s total earnings must be commissions

However, in several states, the exemptions require that the employee’s hourly wage be 1 ½ times the state’s minimum wage, instead of the lower Federal minimum wage.

Those states are California, Colorado, Connecticut, District of Columbia, Minnesota, Nevada, New York, Oregon, and Washington.

Let SwipeClock Help

Businesses with employees in these states with additional exemptions, for those with employees in multiple states may have to comply with multiple conflicting minimum wage laws, salary thresholds, local sick leave and family leave laws and other time and salary based laws.

Additionally, these businesses have to also comply with Federal Overtime Laws, the Family Medical Leave Act and any other national or local laws that are enacted. SwipeClock provides a comprehensive array of workforce management and time tracking tools that can help businesses to more easily stay in compliance with local and national laws.

Records are effortlessly kept for years and accrual is automatically tracked and reported to employees according the state and city laws. Additionally, with geo-timekeeping clocks, businesses can effortlessly track time worked in specific cities to ensure compliance.

References

Commission Employee Overtime Exemption

Written by Annemaria Duran. Last updated on December 19, 2017

Simplify HR management today.

Simplify HR management today.

Your Guide to GPS Time Tracking (Geofencing)

Updated March 19, 2024 When your business has employees working remotely or at various job sites, time tracking can become a challenge, particularly if the company relies on physical clocks for punching in and out. But offering a mobile app or web-based tracking solution can cause some concerns. You might wonder whether employees are clocking…

Read MoreThe Employer’s Guide to Federal & State Meal/Rest Break Laws [See all 50 State Laws Here]

Updated January 23, 2024 Under the federal Fair Labor Standards Act (FLSA), employers are not required to provide meal or rest break periods to employees. However, some states do have laws in effect dictating when and how often an employee should receive a break, as well as whether these breaks are paid or unpaid. In…

Read More