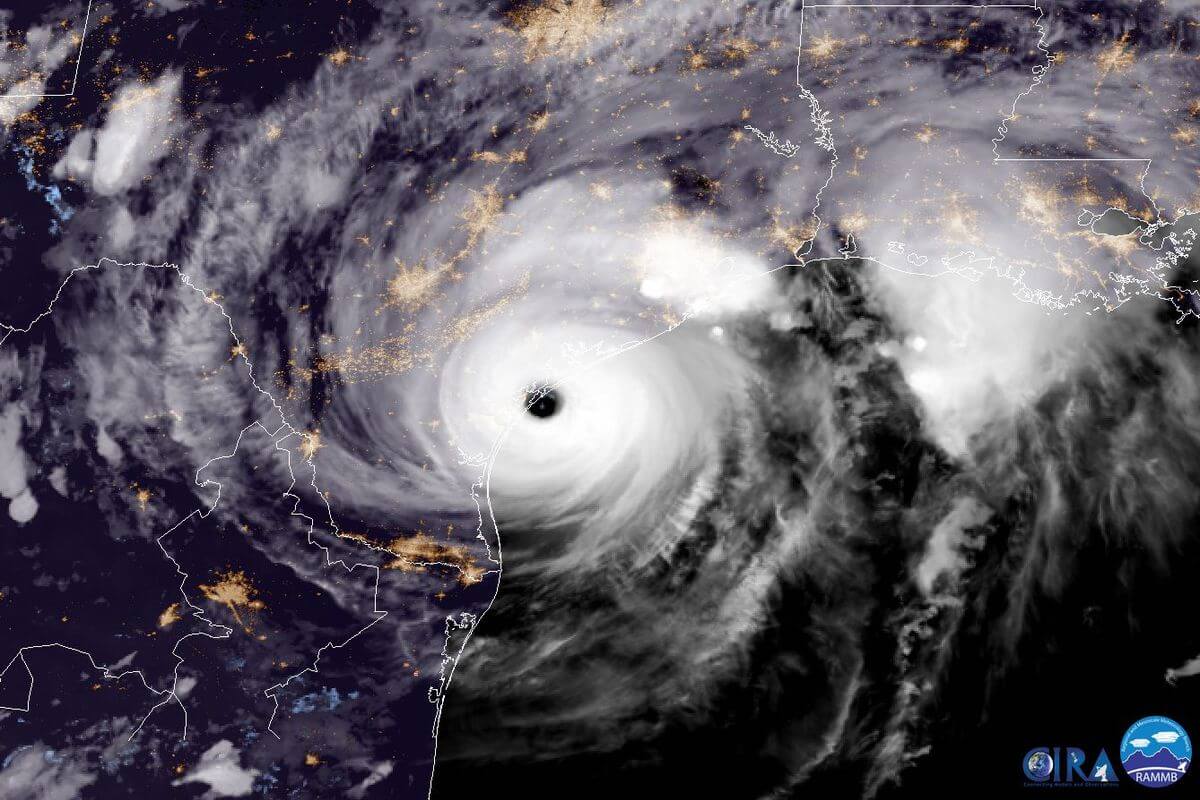

Paying Employees Following Hurricanes Harvey & Irma: What Employers Must Understand

Hurricane Harvey Creates Employer Labor Compliance Issues

Currently, Texans and Louisianans are still dealing with the aftermath of Hurricane Harvey and Irma is raging toward the Florida. In Texas, flooding is rampant and many are still waiting rescue from the water. With nearly 200,000 homes estimated to still be underwater, an unidentified number of businesses are also underwater and unable to resume normal operations.

Business owners and payroll specialists may be wondering how to handle federal and state employment laws during this emergency. The purpose of this article is to review how and when employees should be paid during a natural disaster.

Paying Exempt Employees During a Natural Disaster

During a natural disaster such as Hurricanes Harvey or Irma, exempt employees must be treated in a specific manner. When a business closes from natural disasters for less than a week, the employer must pay the exempt employees for their regular salary for that week.

Under the Fair Labor Standards Act (FLSA) exempt employees who are available to work, but for whom no work is available, cannot have their pay deducted. Otherwise they are at risk of losing their exempt status under the Fair Labor Standards Act (FLSA).

However, an employer can deduct the employee’s paid leave balance for missed work. This means that their paid time off (PTO) or vacation pay can be used to pay their full weekly wages for the time missed while the business is closed. The important aspect is that the employee receives his or her full pay for the entire week.

If the employee does not have any paid time off balance, then the exempt employee must still be paid during business closures that are less than a week long.

If the business is open, but the employee is unable to get to work, then the business can deduct a full day’s salary from the employee’s wages. The FLSA allows employees to deduct exempt employees pay with a full day’s salary without jeopardizing exempt status.

However, if the employee works for any amount of time during the day and the business decides to close due to weather conditions, then the employer cannot deduct a partial day’s salary from their wages. Exempt employees must be paid a full day’s work regardless of number of hours they worked that day. Although pay deductions for partial days are not allowed, leave balances may also be used and deducted for partial day absences.

- Exempt Employee unable to work for less than 1 week: Full weeks pay can be deducted against the employee’s PTO balance

- Exempt Employee unable to work for more that 1 week: Missed work time of over 1 week can be deducted from employee’s pay.

Paying Non-Exempt Employees During Natural Disasters

In Texas and under Federal Law, non-exempt employees must only be paid for hours worked. There is no law that requires payment to hourly employees if they are not working.

However, in some other states or cities, such as parts of California and Washington, employers are required to pay employees if their schedule changes suddenly.

It is also important that employers know that employees cannot volunteer at their place of employment. This includes volunteering to clean up damage from a storm or flood waters.

Although non-exempt employees must only be paid for hours worked, there is an exception when an employee is “on call.” The FLSA defines employees to be on call when they cannot work, but are required to wait at their employers premises and cannot use their time as personal time. In this situation, employees must be paid for their on call time.

Examples of on call time would include when employees stay at work during a power outage, or storm, even if the business is closed during that time.

Employees Working From Home or Other Locations, Temporarily or Long Term

Non-exempt employees who are working from home must be compensated for time worked. Employers will need to put in place a system, like SwipeClock’s online time portal, to track employee hours. Employers are required to compensate hourly employees for all time spent working and this is vital even when the employee did not have express permission to work from home.

Employers should have a clear policy regarding those situations in which employees must work from home and communicate expectations regarding compensation table hours for hourly employees. This will help to eliminate employee confusion and reduce possible abuse.

As stated above, exempt employees must be paid a full day’s wage for any time spent working during the day. That means that if an exempt employee works from home for only a few minutes or a couple of hours to check emails and respond to vital business operations, that employee must be paid a full day’s wage.

If the exempt employee does only work a partial day, even remotely, then the balance of the rest of the day’s pay can be pulled from the employee’s paid leave or PTO balance.

Wage Delays Due to Disaster

In some cases, businesses may not be able to pay employees on the regular pay schedule due to the natural disaster. Payroll employees may not be able to process payroll, or physical equipment may be unavailable following an emergency.

Texas and Louisiana both require that non-exempt employees be paid a minimum of twice a month. If, because of the natural disaster, the employer is unable to meet these requirements, then it is vital that they communicate that and expected pay times with the employees immediately.

The Texas Workforce Commission has stated that if an employer needs to change the scheduled pay date, then they should communicate the next three paydays. That includes 1- the last old payday, 2- the first new payday and 3-the next following payday.

It is vital that employers notify employees in writing of any changes or delays in payments.

If employers have employees in other states, then they should be aware that delaying payments could cause other employment labor fines and penalties to occur in those states.

Businesses should do the best they can to process employee payments, communicate any changes, and document the full reasons for the delay for future reference.

Let SwipeClock Help

Employers who are located in Louisiana and Texas will find that an electronic time and attendance system, like the one provided by SwipeClock, will make emergency preparedness much easier for payroll employees. They may also have questions about FMLA rules in the wake of natural disaster.

Furthermore, they will find it easier to comply with state and federal labor laws in issuing communications through the employee portal, automatically retaining records and storing information of-location.

That will ensure lower stress and eliminate risk factors for businesses that are worrying about other concerns during a crisis.

These employers also have to also comply with Federal Overtime Laws, the Family Medical Leave Act and any other national or local laws that are enacted. SwipeClock provides a comprehensive array of workforce management and time tracking tools that can help businesses to more easily stay in compliance with local and national laws.

Records are effortlessly kept for years and accrual is automatically tracked and reported to employees according the state and city laws. Additionally, with geo-timekeeping clocks, businesses can effortlessly track time worked in specific cities to ensure compliance.

Written by Annemaria Duran. Last updated September 5, 2017

Simplify HR management today.

Simplify HR management today.

Everything You Need to Know About the Corporate Transparency Act (And How It Impacts Your Business)

Staying current on legislation that may impact your business or impose new regulations is vital to remaining in compliance and avoiding costly fines. One piece of legislation that affects nearly all businesses under $5 million in gross revenue is the Corporate Transparency Act. If your business gross revenue comes in under that threshold and you…

Read MoreYour Guide to GPS Time Tracking (Geofencing)

Updated March 19, 2024 When your business has employees working remotely or at various job sites, time tracking can become a challenge, particularly if the company relies on physical clocks for punching in and out. But offering a mobile app or web-based tracking solution can cause some concerns. You might wonder whether employees are clocking…

Read More